Online trading is probably the most popular business and the most profitable that can be done on the INTERNET.

Despite the risk involved in it, the daily trading turnover is getting more huge and more people are getting involved in the act.

Over the years I have come to discover that, to win in Forex, Commodities or any other financial markets, there is a need to learn and learn.

Winning starts by identifying no-nonsense high probability trades and having the patience to run them through.

Winning is not about the number of trades, rather the number of quality trades and the patience and discipline to execute them.

One other thing__ good money management.

This blog, if it has shown anything, has proved that Elliott wave theory is the best markets forecasting tool that also provides opportunities to trade high probability trade set ups with well defined entry, targets and exit levels.

Let's look at a few of Elliott wave patterns that were posted on this blog.

Just recently, we spot an ending diagonal pattern on Gold daily chart. The diagonal was clearly formed at a well measured convergence point.

The article titled

Gold Rally is imminent; how prepared are you? was posted on 21st December

Price has since risen to 1102 from 1065.85 (about 400 pips) is a move that is expected to continue upside.

If you read the whole article, you'd see that the diagonal pattern we traded was in line with the general expected price movement.

As price is expected to surge higher, we provided an alternative in the article titled

Gold Expected Rally; An alternative view.

We are still on diagonal pattern.

#Gbpchf

The chart below was posted as part of our analysis on Gbpchf titled

Gbpchf: The Long Term View

The diagonal pattern was not yet complete and we made a forecast of what is required for the completion.

Of course, price moved exactly as we wanted.

The pattern completed at the region we forecast and what next? We sold and send trade recommendation to our subscribers.

The chart below shows how price responded to the pattern formation.

We made 700pips out of this move risking only 280pips. Is this for real? Absolutely!

Let's look at another interesting diagonal we traded.

#Gbpjpy and #Usdjpy.

Infact, if you have followed all the diagonals we discussed, your accounts should be smilling.

Read articles that show the power of the diagonal. Please take your time and check what happened after the formation on your chart.

Here we go:

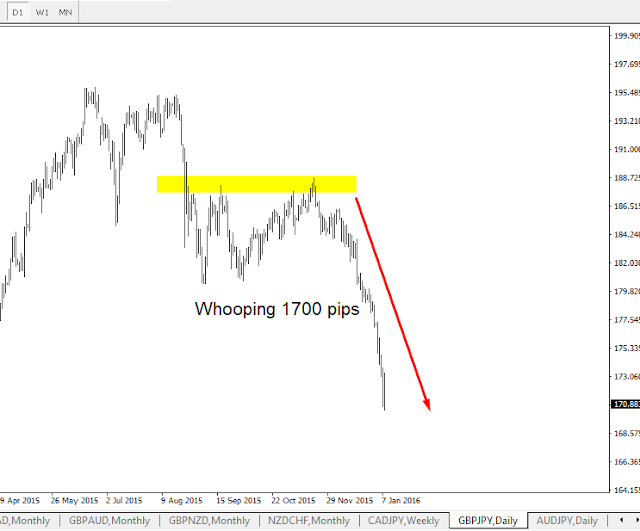

On 13th August 2015. An article titled

Gbpjpy: When will the bears take over?

On August 23, 2015.

Read article titled What drive the diagonals?

At a time , we were posting intra day analysis of some currency pairs. Look at how we follow the price till we get a diagonal and how price reacted to it. Click

here

What about

Euraud rally after the diagonal.... an article posted on 8th June 2015

.....and an

intra day ending diagonal on Gbpusd trade on 22nd February 2015

Before I go; what about the recent one we sent on Audnzd?... Are you among those that received the signal?

Read it

here

Massive...right?

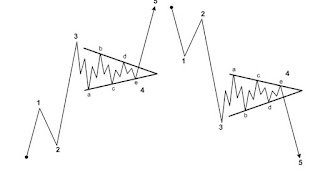

Let's look at another pattern...The Zigzag

The ones that easily come to my mind are the recent ones on AudJpy and GbpJpy (double zigzag)

#AudJpy

This was spotted on AudJpy on December 2, 2015. The

x wave was a clear zigzag pattern, though we didn't zoom to a lower time frame to show its constituent waves.

We sent the signals to our subscribers. The pattern was clear and price respected it.

GbpJpy was more interesting. We forecast the pattern and the requirements for us to consider a sell trade. Price did exactly as we have forecast and BOOM!...... Our subscribers enjoyed this most.

The good thing is the risk/reward ratio, we only risked 280pips.

There are so many zigzag and double zigzag patterns we mentioned on this blog.

Just type 'zigzag' or 'zigzag pattern' in the blog's search box at the top right and read many other zigzag patterns. Read the requirements and if price responded. Where price responded, check the outcome on your chart.

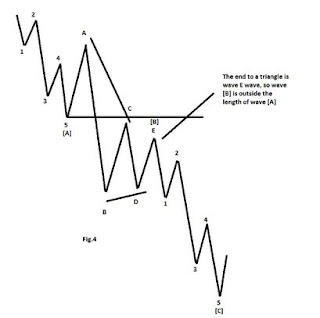

Elliot waves theory has 5 core tradeable patterns.

Others are

Triangles... Read our exploits on Eurusd on

4th August 2015 (click the date to read)

The flat pattern. Example is the Usdcad buy set on

27th October 2015

and the non-overlapping 5-wave pattern generally known as Impulse wave ( probably the most popular elliott wave pattern)

An example... read the forecast on

June 22 2015 and the outcome on

July 13, 2015

Do you need more recent examples?. Check the following pattern setups I discusses at AtoZForex.

1.

500 Pips dip in USDCAD

2.

500 Pips dip in USDJPY

3.

800 Pips rally in EURJPY

4.

700 Pips rally in Gold

5.

1200 Pips rally in GBPCAD

6.

600 Pips dip in CADJPY

7.

250 Pips in EURUSD

There are many more that we spotted this year. These are high rewarding and high probable trade setups that GUARANTEE success.

If only one can be patient for these patterns to complete, they are very reliable.

Why You Should Consider Trading Elliot Wave Patterns

1. They are very reliable if all the rules and guideline are kept. Are they perfect? No. The winning ratio is at an average of 70% i.e you will win 70% of your trades if you can recognize 'textbook-like' clear Elliot wave patterns like the examples I gave above.

2. They can compliment other trading systems like Price Action, Chart patterns and harmonic patterns.

3. They can be confirmed by your set of indicators to give you more confidence.

4. Minimum risk/reward ratio is 1:2. You will always win more dollars when you win than the dollars you lose in a losing trade provided you risk a fixed dollar value for each trade.

5. Elliott wave patterns are best traded at demand and supply levels so support and resistance traders will find them useful.

6. If you go further in the study , Elliott wave theory can be used as a forecasting tool for any market, be it commodities, currencies, energies, stocks, indices, real estate, Etfs or strategies that can be used to trade options, binary options e.t.c

7. They can be used for long term, swing and intra day trades. I do more of long term and swing. They are perfect for intraday trades as well.

In fact, every serious trader should learn how to trade with Elliot wave theory.

Okay, enough of story.

In other to get the valuable skill of spotting these patterns, you should join us and get access to be a part of a growing community of successful traders who use Elliott wave theory the way it's used by professional and expert traders and fund managers.

COURSE MODULES

The outline of the Classic Elliott wave Wave Training/Mentorship course is highlighted below.

1. Basic tenets of Elliott wave theory (EWT)

2. Rules and guidelines

3. The 5 core Elliott wave patterns briefly.

4. Trend Patterns in details (with rules and guidelines)

5. Corrective patterns in details (with rules and guidelines)

6. Fibonacci ratios in price and time

7. Ratio relationship of trend patterns

8. Ratio relationship of corrective patterns

9. The role of support and resistance and trend line analysis in support of Elliott wave patterns.

10. Reversal signals with candlestick patterns and indicators.

11. Momentum analysis and divergence.

12. How to trade the 5 core patterns

- Specific entry levels

- Profit targets

- How to set stop loss

- How to exit a trade

- How to adjust stop loss with respect to market conditions

- How to take sequential profits

13. Trade and Risk management. Risk/reward ratio analysis.

14. Relationship between Elliot wave patterns and harmonic patterns and how to use them together.

15. How to use Elliot wave to confirm chart patterns

And many more.

At the end of the programme, you will have gained the better knowledge of the markets and how to wait for the right set ups.